All Categories

Featured

Table of Contents

Note, nevertheless, that this doesn't claim anything concerning adjusting for inflation. On the bonus side, even if you think your alternative would be to purchase the securities market for those seven years, which you 'd obtain a 10 percent annual return (which is much from certain, particularly in the coming years), this $8208 a year would be greater than 4 percent of the resulting small supply worth.

Example of a single-premium deferred annuity (with a 25-year deferment), with 4 repayment choices. Politeness Charles Schwab. The regular monthly payment right here is highest for the "joint-life-only" choice, at $1258 (164 percent greater than with the immediate annuity). However, the "joint-life-with-cash-refund" choice pays out only $7/month less, and warranties at the very least $100,000 will be paid out.

The method you purchase the annuity will certainly determine the response to that inquiry. If you get an annuity with pre-tax dollars, your costs reduces your taxed earnings for that year. Ultimate repayments (regular monthly and/or swelling sum) are taxed as regular income in the year they're paid. The benefit below is that the annuity may allow you defer taxes past the internal revenue service contribution restrictions on Individual retirement accounts and 401(k) plans.

According to , purchasing an annuity inside a Roth plan results in tax-free settlements. Acquiring an annuity with after-tax dollars outside of a Roth causes paying no tax on the part of each payment attributed to the original costs(s), but the continuing to be portion is taxed. If you're setting up an annuity that starts paying prior to you're 59 years of ages, you may need to pay 10 percent early withdrawal fines to the IRS.

Who provides the most reliable Annuities For Retirement Planning options?

The consultant's primary step was to develop a comprehensive monetary plan for you, and afterwards clarify (a) just how the recommended annuity fits into your total strategy, (b) what options s/he taken into consideration, and (c) just how such options would certainly or would not have led to reduced or greater payment for the consultant, and (d) why the annuity is the superior option for you. - Annuities for retirement planning

Obviously, an expert may attempt pressing annuities even if they're not the ideal suitable for your scenario and goals. The factor could be as benign as it is the only item they sell, so they fall victim to the typical, "If all you have in your toolbox is a hammer, rather quickly whatever starts appearing like a nail." While the advisor in this situation might not be underhanded, it raises the danger that an annuity is an inadequate option for you.

Tax-deferred Annuities

Because annuities usually pay the representative offering them a lot greater payments than what s/he would certainly obtain for investing your money in shared funds - Annuity withdrawal options, not to mention the zero compensations s/he would certainly obtain if you buy no-load shared funds, there is a huge incentive for agents to push annuities, and the much more difficult the much better ()

An unscrupulous consultant suggests rolling that quantity into new "better" funds that simply happen to carry a 4 percent sales lots. Accept this, and the consultant pockets $20,000 of your $500,000, and the funds aren't likely to execute better (unless you picked also a lot more badly to start with). In the exact same instance, the advisor might steer you to purchase a difficult annuity with that said $500,000, one that pays him or her an 8 percent payment.

The expert tries to rush your decision, declaring the deal will soon go away. It might certainly, but there will likely be comparable deals later on. The expert hasn't determined how annuity repayments will certainly be strained. The expert hasn't divulged his/her compensation and/or the charges you'll be charged and/or hasn't revealed you the influence of those on your ultimate settlements, and/or the settlement and/or costs are unacceptably high.

Current passion prices, and thus forecasted repayments, are historically reduced. Also if an annuity is right for you, do your due persistance in comparing annuities offered by brokers vs. no-load ones offered by the releasing company.

What is the most popular Fixed-term Annuities plan in 2024?

The stream of regular monthly settlements from Social Safety and security is similar to those of a delayed annuity. A 2017 relative analysis made an extensive comparison. The complying with are a few of one of the most salient factors. Considering that annuities are voluntary, individuals purchasing them usually self-select as having a longer-than-average life span.

Social Safety and security benefits are completely indexed to the CPI, while annuities either have no inflation defense or at the majority of provide an established portion yearly increase that may or may not make up for rising cost of living in full. This kind of cyclist, similar to anything else that enhances the insurance company's danger, requires you to pay more for the annuity, or approve reduced repayments.

Why is an Long-term Care Annuities important for long-term income?

Please note: This write-up is planned for educational purposes only, and need to not be considered financial suggestions. You must seek advice from a financial specialist before making any kind of major monetary decisions.

Since annuities are planned for retired life, tax obligations and charges may apply. Principal Security of Fixed Annuities. Never ever lose principal as a result of market efficiency as dealt with annuities are not purchased the marketplace. Even throughout market declines, your cash will certainly not be influenced and you will certainly not shed cash. Diverse Financial Investment Options.

Immediate annuities. Used by those who want trusted income instantly (or within one year of acquisition). With it, you can tailor revenue to fit your requirements and create earnings that lasts for life. Deferred annuities: For those who wish to grow their money gradually, but agree to postpone access to the money up until retired life years.

How do I apply for an Retirement Annuities?

Variable annuities: Provides greater capacity for growth by investing your cash in financial investment options you pick and the ability to rebalance your profile based on your preferences and in a way that aligns with transforming financial objectives. With repaired annuities, the company invests the funds and provides a passion price to the customer.

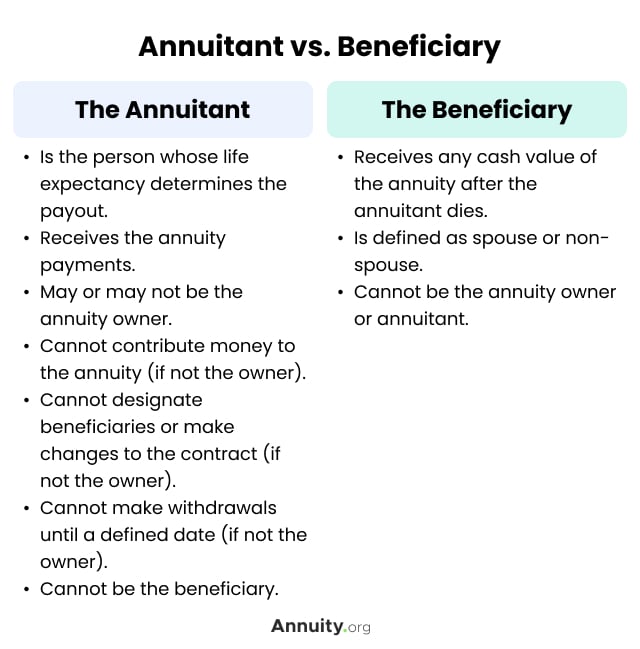

When a death case accompanies an annuity, it is vital to have a named beneficiary in the agreement. Various choices exist for annuity fatality advantages, depending upon the contract and insurance provider. Choosing a refund or "duration particular" option in your annuity supplies a survivor benefit if you die early.

Who has the best customer service for Tax-deferred Annuities?

Calling a beneficiary apart from the estate can assist this procedure go a lot more efficiently, and can help make certain that the earnings go to whoever the specific desired the money to head to rather than experiencing probate. When existing, a survivor benefit is automatically consisted of with your agreement. Depending upon the sort of annuity you buy, you might be able to add boosted death advantages and features, however there could be additional prices or charges related to these attachments.

Table of Contents

Latest Posts

Understanding Financial Strategies A Comprehensive Guide to Fixed Income Annuity Vs Variable Annuity Defining the Right Financial Strategy Benefits of Choosing the Right Financial Plan Why Choosing th

Understanding Tax Benefits Of Fixed Vs Variable Annuities A Closer Look at Fixed Annuity Or Variable Annuity What Is Annuities Fixed Vs Variable? Pros and Cons of Variable Annuities Vs Fixed Annuities

Analyzing Strategic Retirement Planning Everything You Need to Know About Financial Strategies Defining What Is A Variable Annuity Vs A Fixed Annuity Pros and Cons of Various Financial Options Why Cho

More

Latest Posts